Last updated on 2025/05/04

Financial Feminist Summary

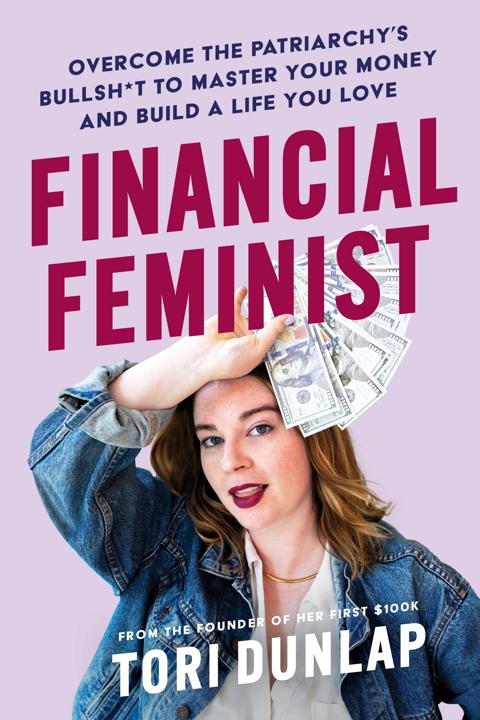

Tori Dunlap

Empowering Women to Take Control of Their Finances.

Last updated on 2025/05/04

Financial Feminist Summary

Tori Dunlap

Empowering Women to Take Control of Their Finances.

Description

How many pages in Financial Feminist?

313 pages

What is the release date for Financial Feminist?

In "Financial Feminist," Tori Dunlap challenges women to reclaim their financial power and equips them with the tools to do so, using a blend of practical advice and personal stories to illuminate the unique financial challenges women face in a patriarchal society. Through her passionate advocacy for financial literacy, Dunlap not only demystifies complex financial concepts but also inspires readers to break free from societal expectations and prioritize their economic independence. This empowering guide is not just about budgeting or investing; it’s a rallying cry for women to understand their worth, take control of their financial destinies, and forge a path towards wealth in all its forms, making it essential reading for anyone ready to embrace their financial future.

Author Tori Dunlap

Tori Dunlap is a passionate financial educator, entrepreneur, and advocate for women's financial independence, known for her dynamic approach to personal finance. With a background in marketing and a commitment to empowering women, she founded Her First $100K, a platform dedicated to teaching women how to take control of their money and build wealth. Tori's relatable and accessible style has resonated with countless individuals, as she combines practical financial advice with a feminist perspective, making complex financial concepts easier to understand. Through her work, including the insightful book "Financial Feminist," she aims to dismantle the societal barriers that women face in achieving financial security and independence.

Financial Feminist Summary |Free PDF Download

Financial Feminist

Chapter 1 | The Emotions of Money

In Chapter 1 of "Financial Feminist," Tori Dunlap emphasizes the importance of understanding the emotional complexities surrounding money, illustrating this through her meaningful connection with her best friend, Kristine. After years of enduring a toxic work environment, Kristine's struggles resonate with many who feel trapped in unfulfilling situations. Tori highlights the common impulse to offer straightforward advice, yet recognizes that emotional processing is the foundational step towards meaningful change. 1. Emotional Processing Before Action: Tori's early experiences as a money educator taught her that without addressing the emotional roots of financial behaviors, attempts at providing solutions often lead to temporary fixes. Understanding and confronting how emotions affect money decisions is crucial in achieving lasting change. 2. The Psychological Nature of Money: Money is inherently tied to our emotions and mental states. Tori shares her own experiences of mindless spending during moments of stress, underscoring that our feelings—be it anxiety, shame, or guilt—greatly influence our financial decisions. 3. Shame as a Barrier to Financial Education: The chapter delves into the emotion of shame, identified as a pervasive barrier in financial literacy, particularly affecting women. Tori discusses how societal expectations can lead to a warped sense of self-worth tied to financial standing, making discussions about money feel taboo. 4. The Five Patriarchal Narratives: Tori introduces five patriarchal narratives that hinder financial progression: - You Should Know "How to Money": Women often feel inadequately educated about finance, leading to self-blame for lack of knowledge. - Talking About Money Is Impolite: Cultural conditioning discourages open discussions around finances, creating an environment where individuals do not share valuable experiences that could help each other. - You'll Be Rich If You Just Work Hard!: This narrative ignores systemic barriers that disproportionately affect women and marginalized groups, suggesting that hard work is the sole path to wealth. - Wanting Money Is "Selfish" Unless You're a Man: Women face guilt for seeking financial independence or success, as societal norms valorize selflessness over ambition. - "Money Can't Buy You Happiness": This phrase undermines the real benefits that financial security brings, such as peace of mind and freedom, suggesting that wanting wealth is inherently wrong or greedy. 5. Reframing Shame and Guilt: Acknowledging these narratives allows individuals to transform their relationship with money from one of shame to empowerment. Tori encourages readers to embrace vulnerability, making connections that foster financial learning and growth. In this chapter, Tori provides actionable insights such as journaling exercises designed to unpack personal money memories and beliefs. By reflecting on these memories and identifying how they shape current relationships with money, individuals can envision a more empowered financial future. Tori's ultimate message is one of hope and empowerment: by understanding and navigating our emotional relationships with money, we can overcome societal narratives that limit us, ultimately achieving financial confidence and independence. Through community support and open dialogue, women can dismantle these narratives and redefine their financial journeys, leading to greater choices, stability, and joy.

Key Point: Emotional Processing Before Action

Critical Interpretation: Imagine standing at the edge of a vast ocean, the waves of your financial anxieties crashing around you. Tori Dunlap emphasizes the importance of understanding your emotional complexities surrounding money before diving into the tumultuous waters of budgeting and saving. You feel drawn to her journey as she pairs personal stories with profound insights, illuminating that it’s not merely about the cash flow but rather the heart flow. When you take a moment to process your feelings—acknowledging the fear, shame, or guilt that bubbles up—you begin to realize that these emotions are not just obstacles but clues to understanding your money habits. Just as Kristine’s struggles resonate, your own experiences reflect a longing for change. By courageously facing these emotions, you unlock the courage to take meaningful action in your financial life, emboldened to break free from limitations. Through this realization, you discover that true empowerment comes not from superficial solutions, but from a deep, personal reconciliation with your financial narrative.

Chapter 2 | Spending

In Chapter 2 of "Financial Feminist" by Tori Dunlap, the discussion centers around the cultural narratives surrounding women's spending habits and how these narratives are often fraught with gender-based misconceptions. Dunlap begins by highlighting a striking discrepancy in financial advice targeted at men compared to that aimed at women, underscoring that while men receive guidance that encourages wealth-building through investments and salary negotiations, women's financial advice often emphasizes frugality and saving, accompanied by derogatory language labeling them as excessive spenders. 1. The prevailing message in financial advice often misrepresents women's spending. While articles for women advise them to save money and cut costs, those aimed at men promote wealth-building strategies. This reflects a wider societal tendency to diminish women’s financial agency, suggesting that their spending habits impede wealth accumulation, rather than recognizing their significant economic influence as consumers. 2. Women constitute a significant portion of consumer spending yet are often shamed for the very purchases that contribute to the economy. Dunlap points out that women’s spending has historically been framed as frivolous, with unnecessary items like luxury handbags critiqued, while similar spending by men (e.g., expensive watches) goes unquestioned. This creates an inherent bias in how society perceives and values financial choices based on gender. 3. Dunlap explains the additional pressures women face regarding appearance-related spending, echoing the societal expectation that women must invest time and money into their appearance to be viewed as professional or acceptable. Anecdotes about the lengths women go to for grooming highlight the emotional and financial burdens imposed on them. 4. The concept of the "pink tax" is introduced, where women's products are often priced higher than similar items marketed toward men, leading to a financial disadvantage that is overlooked by traditional budgeting advice that fails to account for systemic disparities. 5. Critically, Dunlap emphasizes that spending is not inherently bad or frivolous; rather, it is the context and awareness behind spending choices that matter. She challenges the cultural narrative that positions women’s financial decisions in a negative light, advocating for a mindful approach to spending that reflects personal values and priorities. 6. Dunlap introduces the idea of the “Money Diary” as a tool for self-reflection and deeper understanding of spending patterns. This practice involves tracking all purchases for a month, along with the rationale and emotions associated with each expenditure. It encourages mindfulness in spending and helps individuals align their budgets with their personal values. 7. Through the process of maintaining a Money Diary, readers are asked to assess essential versus discretionary expenses, ultimately helping them identify areas for potential savings while fostering intentional spending on what genuinely brings joy and fulfillment. 8. To enshrine the importance of thoughtful spending, Dunlap urges readers to identify their "Three Value Categories,” allowing them to prioritize spending based on what they truly value and desire in their lives. 9. Finally, Dunlap asserts that financial literacy is inherently personal; thus, one’s approach to finance should encompass individualized values rather than conforming to generalized, often gendered, financial expectations. She emphasizes that understanding personal spending not only enhances financial decision-making but also fosters a sense of empowerment. In summary, Chapter 2 challenges prevailing narratives that criticize women’s spending habits while advocating for a more nuanced understanding of financial agency and the importance of mindful, value-based expenditures. It serves as a call to redefine how we engage with our finances, recognizing the role of emotion and societal expectation in shaping our financial behavior.

Chapter 3 | The Financial Game Plan

In Chapter 3 of "Financial Feminist," Tori Dunlap introduces vital concepts that set the stage for understanding and improving personal finance, emphasizing that financial empowerment and ownership are both essential. This chapter revolves around several key principles, guiding readers to create a comprehensive financial game plan while avoiding the common pitfalls that lead to poor financial health. 1. The Ostrich Effect: Dunlap uses the analogy of ostriches, known for burying their heads in the sand, to illustrate the cognitive bias that many face in personal finance—choosing ignorance over acknowledging financial realities. This avoidance, often rooted in shame or anxiety, hampers progress and can create deeper financial problems. The chapter elucidates the need to confront financial realities rather than escape from them. By ignoring personal finance details, one's progress in managing debt, building savings, or investing remains unseen and unappreciated. 2. The Importance of Setting Personal Financial Goals: Central to overcoming financial anxiety is the establishment of clear and meaningful financial goals. Dunlap emphasizes that goals should align with individual values and desires, rather than societal expectations. The misconception that one must, for instance, buy a house simply because it is a perceived milestone is challenged. Readers are encouraged to identify their "why" behind financial goals, making them more compelling and motivating. 3. The Financial Priority List: To streamline financial management, Dunlap advocates for a structured approach to prioritizing financial goals. This list entails several steps: - Emergency Fund: The foundation of financial security begins with saving three to six months of living expenses in a high-yield savings account (HYSA). This fund provides a financial cushion against unexpected expenses and reduces reliance on high-interest debt during emergencies. - Paying Off High-Interest Debt: Targeting debts with interest rates above 7%—such as credit cards—takes precedence to prevent compounding financial strain. By eliminating these debts, one can better allocate resources to savings and investment. - Investing for Retirement: Dunlap encourages setting aside funds for retirement while concurrently addressing lower-interest debt. Investing early, ideally aiming for contributions of 20% of gross income, ensures that Future You is well-prepared financially. - Saving for Major Life Events: Financial objectives, such as saving for a home purchase, travel, or education, are categorized as exciting life goals that should be pursued together with routine savings and retirement investments. 4. Budgeting as Liberation: Rather than viewing budgeting as a restrictive practice, Dunlap reframes it as a liberating tool. By outlining a '3 Bucket Budget,' she emphasizes organizing finances around necessities, goals, and discretionary spending. The first bucket captures essential expenses, the second is for financial goals, and the third allows for indulgence and enjoyment. This approach champions mindful spending by linking financial health with personal values. 5. The Power of Automation: One of the most transformative steps discussed is automating finances. By setting up automatic transfers for bills and savings, individuals can create a self-sustaining financial system that effectively minimizes anxiety around money management. Automation empowers readers to prioritize saving and bill payments effortlessly, allowing for a more flexible and enjoyable approach to discretionary spending. Dunlap concludes beyond the practicality of budgeting and organizing finances by urging readers to take actionable steps, including avoiding the Ostrich Effect, setting personal and specific financial goals, and adopting the Financial Priority List approach. The chapter serves as a compelling invitation for individuals—especially women—to reclaim their financial power, encouraging active participation in shaping their financial futures.

Chapter 4 | Debt

The journey through debt and economic challenges depicted in Chapter 4 of "Financial Feminist" by Tori Dunlap provides a deep dive into the nature of debt as it is experienced by students, particularly focusing on the burdens carried by women and minorities. The author artfully narrates a personal recollection that reveals the harsh realities of college debt, a narrative that illuminates the broader societal issues surrounding financial literacy and equity. 1. The realization of debt's weight first struck Dunlap during a casual dorm room discussion where a friend revealed her impending six-figure student loan debt—a concept both shocking and incomprehensible for their age. This stark introduction to debt serves as a gateway to discussing the historical and cultural contexts of indebtedness in society. From ancient systems of debt to contemporary figures showcasing how debt remains prevalent, the narrative underscores its pervasive nature in American life—a reality reflected in aggregate consumer debt exceeding $14.6 trillion. 2. Dunlap reveals the predatory aspects of the financial systems that further burden marginalized communities, detailing how high-interest loans, such as payday loans averaging an almost unconscionable interest rate of 400%, exploit those already vulnerable. Aspects of systemic inequality begin to emerge here as she recounts her upbringing as a child of a single mother, drawing connections between personal experience and broader cultural issues. The author exposes the painful reality of marginalization within financial systems, where people often endure exploitative practices that ensnare them in cycles of debt. 3. A concerning misconception that arises is the social stigma attached to debt, promoting the false narrative that indebted individuals are somehow inferior or irresponsible. Dunlap emphasizes that one's self-worth is separate from one's net worth, critiquing financial experts who perpetuate shaming attitudes toward those in debt. This highlights the need for a collective shift in mindsets toward understanding debt not as a personal failing but as a systemic issue that affects many due to a lack of financial education. 4. Not all debt is created equal, underlining the importance of differentiating between necessary and unnecessary debts. For instance, student loans often carry the responsibility of establishing a future, while credit card debt can lead to debilitating financial spirals due to high-interest rates. Discussion of leverage in the context of wealth illustrates how those with means often view debt through a different lens than those striving to simply stay afloat. 5. Addressing student loan burdens reveals that women, especially women of color, are disproportionately affected. With statistics indicating that women carry two-thirds of student loan debt, the structural inequities that exacerbate financial struggles come to the forefront. Dunlap argues that financial freedom is not just a personal triumph—it's an act of defiance against a system designed to perpetuate inequity. 6. Realizing the complexities of interest can empower individuals to take control of their financial situations. Learning how compound interest works, particularly when it comes to credit card debt, illustrates the importance of understanding the fine print. Dunlap shares the crucial strategy of addressing high-interest loans first to alleviate financial pressure, providing actionable steps to empower the reader on their journey to debt freedom. 7. Dunlap encourages individuals to challenge the status quo by actively negotiating interest rates, thus taking small but significant steps towards reclaiming power from lenders. By teaching readers to adopt a proactive approach in handling their debts—such as prioritizing payments, understanding how to apply additional payments toward principal amounts, and being relentless in seeking better terms—she outlines the path toward financial independence. 8. For those grappling with the burden of debt, the chapter concludes with actionable homework, including reflecting on personal beliefs about debt, negotiating lower rates with creditors, and formulating a plan to manage and eventually eliminate debt. The narrative stresses the importance of community and discussions surrounding debt, advocating a unified front against the oppressive realities of debt. As Dunlap beautifully weaves her experiences and insights throughout this chapter, she challenges readers to reexamine their perceptions of debt, embrace financial knowledge, and take actionable steps towards breaking free from the constraints that society places upon their economic identity.

Key Point: Understanding Self-Worth Separately from Net Worth

Critical Interpretation: Imagine standing before a mirror, confronting not just your reflection but the weight of societal judgments attached to it. Dunlap's insight—that your self-worth is intrinsically separate from your net worth—urges you to shatter the stigma surrounding debt and embrace the idea that financial struggles do not define your value as a person. This revelation could inspire you to view your financial journey through a lens of empowerment rather than shame. By recognizing that many face similar challenges, you can foster a sense of solidarity with others navigating financial difficulties. This newfound perspective encourages you to pursue knowledge and strategies with vigor, challenging outdated narratives that equate debt with irresponsibility. With this shift in mindset, you’re propelled towards not only taking control of your financial destiny but also supporting others in their journey, cultivating a community of resilience and hope.

Chapter 5 | Investing

In Chapter 5 of "Financial Feminist," Tori Dunlap delves into the critical subject of investing, particularly as it pertains to women. She begins her narrative with a personal anecdote that connects her financial expertise to a broader commentary on gendered perceptions of investing. Observing tourists at the iconic Charging Bull in New York—a symbol of financial prosperity—Dunlap points out the hyper-masculinity associated with such financial imagery, illustrating a barrier for many women who feel intimidated by the investing world. 1. The Wealth and Investing Gap: Dunlap highlights the stark disparities in wealth accumulation between men and women, emphasizing that the investing gap contributes significantly to the overall wealth gap. While the median wealth for single women is notably lower than that of men, women of color face even steeper disparities, which can lead to increased poverty rates among older women. Unsurprisingly, a contributing factor to this gap is the wage disparity, which leaves women with less disposable income to invest. 2. Fear and Confidence: Fear is a pervasive barrier preventing women from investing. Dunlap recounts that women in her workshops frequently cite fear of making mistakes or losing money as the primary reasons for not beginning to invest. She asserts that this fear is taught and enforced by a financial industry predominantly dominated by men. Historically, women have made strides in finance, yet their representation remains limited, with only a small percentage of financial advisors being women. 3. Common Misconceptions about Investing: Dunlap addresses four prevalent misconceptions that deter women from investing: 1. The belief that saving in a traditional savings account suffices. She argues that returns from savings accounts are insufficient to beat inflation, whereas investing in stocks often yields much higher returns over time. 2. The idea that investing is akin to gambling. Dunlap clarifies that while investing carries risks, a long-term approach significantly increases the likelihood of earning returns, contrasting this with the unpredictable nature of gambling. 3. The notion that one can afford to wait to invest until more funds are available. Dunlap emphasizes the power of time in investing, illustrating how even small amounts can grow substantially through compounding over many years. 4. The belief that investing is overly complicated. Dunlap asserts that investing is straightforward once the basics are understood, and that financial jargon often exists to gatekeep knowledge and intimidate novice investors. 4. Getting Started with Investing: Dunlap provides a roadmap for those new to investing, underscoring the importance of beginning as soon as possible. She outlines essential steps, including establishing an investing goal, opening an appropriate account (401(k), IRA), and selecting investments—preferably diversified index funds. She emphasizes that the act of investing itself is crucial for future wealth generation, with the moral imperative of investing not only for personal gain but for broader societal impact. 5. Investment Education and Resources: Dunlap introduces her platform, Treasury, designed to offer supportive financial education aimed specifically at women. Here, she fosters a community where women can learn about investing in an empowering environment devoid of traditional finance's jargon-heavy culture. Through her engaging narrative and actionable advice, Dunlap seeks to demystify investing for women, urging them to take charge of their financial futures. She makes a compelling case that investing isn't just a means to wealth; it’s a crucial step toward achieving financial independence and security. Ultimately, she champions the need for women to not only participate in investing but to embrace it, enabling a transformative impact on their financial health and overall empowerment.

Key Point: Fear and Confidence

Critical Interpretation: Imagine standing at the edge of a vast ocean, where every wave represents a chance for your financial future. In Chapter 5 of 'Financial Feminist,' Tori Dunlap addresses a feeling you might know all too well: fear. It's that nagging voice in your head telling you that investing is too risky, too complex, or simply not meant for you. But what if you could silence that voice? Dunlap emphasizes that acknowledging and overcoming this fear is the first step towards taking control of your financial destiny. By empowering yourself with knowledge and seeking supportive communities, you can transform investing from a daunting challenge into an exciting opportunity. This chapter invites you to reshape your perception of investing—not as a high-stakes gamble, but as a strategic, rewarding journey toward financial independence. As you learn to trust yourself and your decisions, you'll find that each investment is not just a step toward personal wealth, but a bold declaration of your value and potential in a world that has long tried to undermine it.

Chapter 5 | Earning

In this chapter, Tori Dunlap reflects on her early career experiences and the broader systemic issues that shape women's earning potential in the workplace. Starting with her own journey, she describes how her aspirations for a corporate career quickly fell apart when she entered the reality of a toxic work environment filled with poor leadership and a culture of misconduct. She candidly acknowledges her difficulty in navigating the traditional nine-to-five structure and highlights her long-standing entrepreneurial spirit, which prompted her to pursue side hustles while learning valuable financial skills. The chapter underscores key principles and statistics about the gender wage gap, revealing that women earn significantly less than their male counterparts across various demographics and industries. Dunlap points out that societal expectations and historical inequalities lead to self-doubt, particularly in negotiations. She emphasizes that factors beyond individual effort, like systemic barriers and company policies, heavily influence earning potential and career growth. 1. The Importance of Earnings: Dunlap argues that earning money is foundational to financial success, as it enables savings, debt repayment, and investments. The systemic wage disparity faced by women and marginalized communities compounds their financial challenges. 2. Misconceptions About Careers: She outlines several misconceptions that keep individuals from advocating for their worth, such as believing it's not the right time to negotiate, that hard work alone will lead to recognition, and that loyalty will be rewarded. Dunlap encourages readers to question these narratives and to understand that employers often do not prioritize employee welfare. 3. Negotiation Tactics: The chapter provides a deep dive into negotiation strategies, highlighting the necessity of advocating for oneself and understanding market rates. Tori stresses the importance of researching salary benchmarks, presenting one's unique value, and preparing for negotiations that may require multiple conversations. 4. Alternative Paths to Increased Income: Dunlap presents three primary ways to enhance earning potential: negotiating for higher pay in a current role, exploring new job opportunities with better compensation, or creating a personal business or side hustle. She stresses that negotiation should be approached as a collaborative process rather than a confrontational one. 5. The Reality of Side Hustles: Tori discusses the risks of hustle culture, asserting that while side hustles can provide additional income, they should not come at the cost of well-being. She advises readers to evaluate their time, talents, and financial needs before committing to a side project, suggesting a strategic and balanced approach. 6. The Power of Transparency: One crucial takeaway is the importance of discussing salaries openly among peers to combat the culture of secrecy that perpetuates wage inequality. Tori encourages readers to have candid conversations about compensation, fostering a culture where everyone is aware of their worth. 7. Empowering Advocacy: Throughout the chapter, Dunlap emphasizes that creating a supportive network and advocating for oneself is vital in the fight against systemic inequalities. She illustrates this with real-life examples, encouraging individuals to harness their experiences, share knowledge, and uplift others in professional spaces. By interweaving personal anecdotes with rigorous analysis, Tori Dunlap’s chapter serves as both a motivational guide and a call to action for women to embrace their worth and actively engage in their financial futures. She asserts that while the path to fair compensation is fraught with challenges, awareness, strategic negotiation, and community support can lead to significant change.

Key Point: The Power of Transparency

Critical Interpretation: Imagine sitting down with your friends or colleagues, engaging in an open and honest conversation about salaries, what everyone brings in, and the financial struggles you face. This chapter’s emphasis on the power of transparency empowers you to break free from the chains of silence that often surround discussions about money. By sharing your own financial experiences and learning from those around you, you start to dismantle the culture of secrecy that perpetuates wage inequality. You realize that it's not just about your own worth; it's about collectively uplifting one another, fostering a community where everyone recognizes their value. With this newfound clarity, you’re inspired to advocate for yourself more fiercely and to encourage others in your network to do the same, transforming not only your financial situation but also contributing to a broader push for equitable pay.

Chapter 7 | Living a Financial Feminist Lifestyle

In Chapter 7 of "Financial Feminist," Tori Dunlap guides readers through integrating financial feminism into everyday life, emphasizing the importance of personal financial stability before helping others. Celebrating the reader's journey so far, she highlights the learnings gained about emotional influences on money choices, the difference between mindful spending and budgeting as deprivation, and strategies for fair pay and investing. 1. Self-Care as Financial Feminism: Dunlap makes a compelling argument for prioritizing self-care in financial matters, asserting that true altruism begins with a stable foundation. Using the metaphor of put on your oxygen mask first during airplane safety demonstrations, she stresses that neglecting one’s financial health can lead to personal bitterness and undermine the ability to support others. 2. Overcoming Overwhelm: Dunlap advises against attempting too many changes at once, which can lead to paralysis rather than progress. Instead, she encourages readers to tackle one objective at a time, reinforcing the importance of manageable, incremental steps over chaotic, unrealistic expectations. 3. Creating Financial Habits: Emphasizing the concept of a "Money Date," Dunlap advocates scheduling regular intervals dedicated to reviewing financial goals and strategies. These sessions offer a chance for thoughtful reflection on expenditures, progress towards financial goals, and adjustments required to maintain or enhance financial health. 4. Tracking and Optimizing Goals: She suggests a systematic approach to evaluating financial progress, checking spending habits against set goals, and recognizing both achievements and areas needing improvement. This continuous cycle of reassessment helps ensure that one remains aligned with their financial aspirations. 5. Emotional Resonance of Money: When financial struggles arise or when setbacks occur, Dunlap emphasizes the importance of reconnecting with the emotional “Why” behind financial goals—this connection can offer the motivation needed to persist through challenging times. 6. Community and Conversations: Dunlap encourages readers to foster open discussions about finances with friends, family, and peers, reframing money conversations as a way to normalize financial discussions and combat feelings of shame. This vulnerability can create bonds of accountability and community support. 7. Using Money as a Force for Change: Dunlap concludes with a call to action: once individuals achieve their financial goals, they should leverage their understanding for the greater good. She stresses that collectively, small changes in financial habits can spark larger societal shifts towards equity. Ultimately, the chapter emphasizes that the journey toward financial independence and empowerment is not just about individual gain; it is about creating a ripple effect of change that can help dismantle systemic financial inequality. Through self-care, community engagement, and ongoing education, individuals can embody the principles of financial feminism and inspire broader societal change.